Hi friend,

Today I shall be looking at Gold as a financial instrument. From ancient times, Gold has been an extremely sought-after object, from the ancient Egyptians to wall street investors. Gold has always been perceived as a form of luxury and riches. Even though Gold has few practical usages outside of industrial applications, and there are metals that are rarer than Gold on Earth, Gold is the highest-priced rare metal.

This concept of Gold having a high perceived value is important to us. As it would mean that Gold has value because we believe that it has value collectively. With that understanding, let us move onto the definitions:

Gold is often looked at as a store of value, but it's also a highly speculative asset linked to currencies and interest rates. - Investopedia

Erm... This is the first time where Investopedia's answer is not comprehensive.

Allow me to explain the Unique-Selling-Point (USP) of Gold:

1. Function as a store of value - Gold is widely accepted in the world. This is important in countries where the currency is unstable.

2. Negatively correlate to the market in times of volatility - Example would be during a financial crisis, Investors would flock to Gold due to its relatively stable prices.

#I will be doing a study to look at the correlation of different financial instruments with stocks. #

3. Limited supply - Has a tendency to increase in value

"That's great! How do I invest in it?"

Woah. Wait, let me go through the advantages and disadvantages.

Advantages:

1. Acceptable form of currency everywhere

2. Hedge against inflation and a down market (When the market is fearful)

3. Easy to buy and well-established financial institutions that regulate Gold

4. It makes you happy when you physically touch it.

Disadvantages:

1. Large spread and fees if you were to buy it

2. Storing physical Gold is troublesome

3. Gold can still have fluctuations in prices

4. If your country does not have establishments that allow you to liquidate Gold at a fair price, it will be useless to have Gold.

How to buy Gold?

1. Physical Gold (In Singapore, you can purchase it from UOB, or Gold retailers, or Gold Jewellery)

2. Gold Certificates (These certificates allow you to exchange for cash or Gold readily)

3. Gold Savings Accounts (UOB has this. It saves you the hassle of finding a place to store the physical Gold)

4. Gold ETFs or other funds (SPDR Gold Shares ETF)

5. Buying Gold-related companies (like K92 Mining Inc. (KNT) - Gold Mining Companies)

1. Physical Gold (In Singapore, you can purchase it from UOB, or Gold retailers, or Gold Jewellery)

2. Gold Certificates (These certificates allow you to exchange for cash or Gold readily)

3. Gold Savings Accounts (UOB has this. It saves you the hassle of finding a place to store the physical Gold)

4. Gold ETFs or other funds (SPDR Gold Shares ETF)

5. Buying Gold-related companies (like K92 Mining Inc. (KNT) - Gold Mining Companies)

Thoughts and Comments:

I cannot deny that looking at a pile of glittering Gold invokes an irrational sense of joy in me (I have never seen it before. If you have, I would like to see it please). There is a reason why we would want Gold in our portfolio as well. It can serve as a damper to it, especially in times of market volatility.

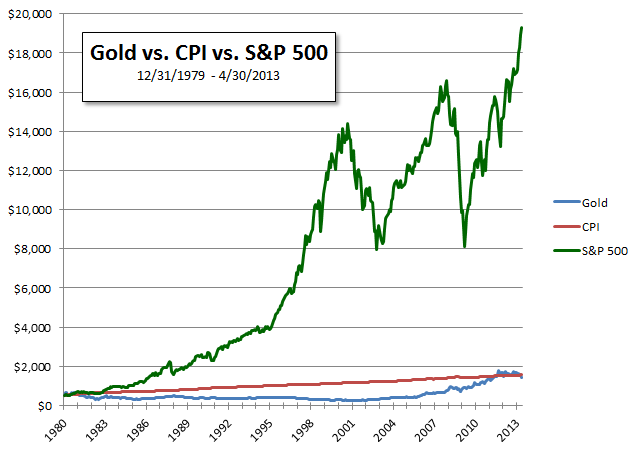

However, Gold does not produce any value by itself. It is just that; Gold. Warren Buffett does not believe in it as it does not create value to itself and its speculative nature. There is not much practical usage to Gold, hence, we cannot rely on market demands in our investment strategy. I do appreciate the value that Gold brings to our portfolio and it is included in Ray Dalio's all-weather portfolio. You can also see that Gold underperforms the S&P 500 in the picture below

Essentially: If you want to incorporate Gold into your portfolio, sure. But it should not be all of it.

With that, I hope that you have a better understanding of Gold as a financial instrument.

Till next time,

Stay vested, stay frugal my friends.

Dionysius

I cannot deny that looking at a pile of glittering Gold invokes an irrational sense of joy in me (I have never seen it before. If you have, I would like to see it please). There is a reason why we would want Gold in our portfolio as well. It can serve as a damper to it, especially in times of market volatility.

However, Gold does not produce any value by itself. It is just that; Gold. Warren Buffett does not believe in it as it does not create value to itself and its speculative nature. There is not much practical usage to Gold, hence, we cannot rely on market demands in our investment strategy. I do appreciate the value that Gold brings to our portfolio and it is included in Ray Dalio's all-weather portfolio. You can also see that Gold underperforms the S&P 500 in the picture below

Essentially: If you want to incorporate Gold into your portfolio, sure. But it should not be all of it.

With that, I hope that you have a better understanding of Gold as a financial instrument.

Till next time,

Stay vested, stay frugal my friends.

Dionysius

Blue line is the Dow Jones Industrial Average (30 most influential stocks in the US) and the Orange line is Gold.

Sources:

https://www.investopedia.com/gold-4689769

https://www.thegoldbullion.co.uk/the-advantages-and-disadvantages-of-investing-in-gold/

https://www.thebalance.com/pros-and-cons-of-owning-assets-like-gold-1290619

https://thecollegeinvestor.com/12481/the-pros-and-cons-of-investing-in-gold/

https://blog.moneysmart.sg/invest/investing-gold-singapore/

https://blog.seedly.sg/how-to-invest-in-gold-singapore/

https://www.fool.com/investing/does-warren-buffett-invest-in-gold.aspx

https://www.marottaonmoney.com/since-1979-the-sp-500-grew-13-5-times-greater-than-the-price-of-gold/

https://www.macrotrends.net/2608/gold-price-vs-stock-market-100-year-chart

0 comments:

Post a Comment