Hi friends,

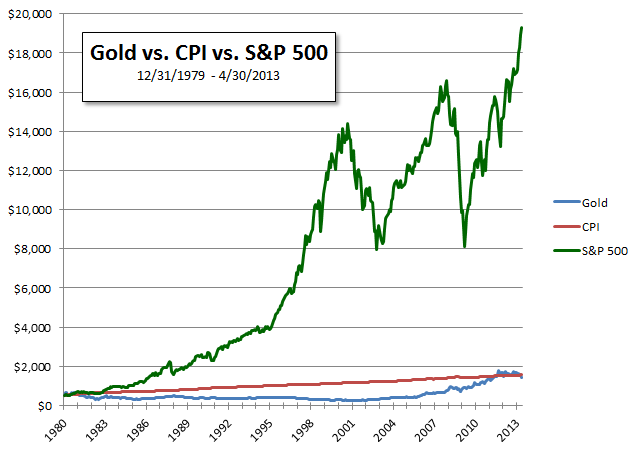

Today I shall be talking about something that is similar to the All-Weather portfolio, and one that is compared to the All-Weather by other financial writers. This portfolio has a higher exposure to stocks as compared to the All-weather. It is supposed to have a similar return as the US stock market but with lower volatility.

This portfolio was constructed by the founder of Portfoliocharts.com, Tyler (Who is a mechanical engineer *hint* *hint*). I aim to be like him one day, even though my field of study isn't in finance, I would want to correct information to my readers for them to make the correct financial decisions in their lives.

This portfolio was an extension of the permanent portfolio, which is designed to do well in the four possible economic conditions (Prosperity - Stocks, Recession - Bonds, Inflation - Gold, Deflation - Stocks and Gold)

Golden-Butterfly Portfolio:

Stocks: 40% (20% Small-Cap IJS, 20% Total Stock Market VTI)

Bonds: 40% (20% Long-Term Treasury Bond TLT, 20% Short-Term Treasury Bond SHY)

Commodities: 20% (20% Gold Trust GLD)

Backtest of data:

Using data from lazyportfolioetf.com

Assuming all dividends reinvested, rebalanced at the start of every year

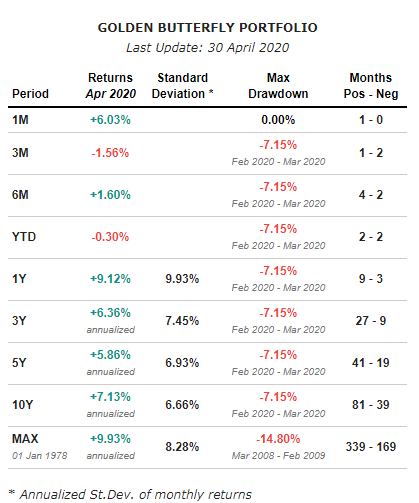

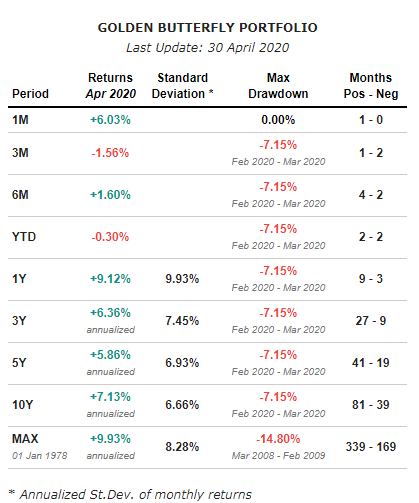

This is a really interesting return, as we can see that in 15 years rolling returns, the average annual return is 9.34%, and the worse possible case is 7.09%. I would say that I would want 20-years rolling returns ... so...

But there is a need for you to understand that it doesn't mean that you will not experience losses, there is still a standard deviation of 8.28%. It just means that over a long period, there is a lowered chance of you ending up losing money.

Thoughts and comments:

I would say that I can understand the appeal of this portfolio, as it has a higher exposure to safer assets and hence, would have a more consistent return. It would be suitable for investors who do not want to see too big a drop in their portfolio and would let their emotions take control of their investment approach.

I would say that if you can stomach the fluctuations of the market, you can consider sticking to a more risky portfolio. But yes, you should always try to understand your risk appetite.

Sources:

https://www.theoptimizingblog.com/golden-butterfly-portfolio/

https://portfoliocharts.com/2016/04/18/the-theory-behind-the-golden-butterfly/

http://www.lazyportfolioetf.com/allocation/golden-butterfly/

https://www.thesimpledollar.com/investing/retirement/why-i-chose-this-controversial-all-weather-portfolio-for-my-life-savings/

https://portfoliocharts.com/portfolio/golden-butterfly/

Today I shall be talking about something that is similar to the All-Weather portfolio, and one that is compared to the All-Weather by other financial writers. This portfolio has a higher exposure to stocks as compared to the All-weather. It is supposed to have a similar return as the US stock market but with lower volatility.

This portfolio was constructed by the founder of Portfoliocharts.com, Tyler (Who is a mechanical engineer *hint* *hint*). I aim to be like him one day, even though my field of study isn't in finance, I would want to correct information to my readers for them to make the correct financial decisions in their lives.

This portfolio was an extension of the permanent portfolio, which is designed to do well in the four possible economic conditions (Prosperity - Stocks, Recession - Bonds, Inflation - Gold, Deflation - Stocks and Gold)

Golden-Butterfly Portfolio:

Stocks: 40% (20% Small-Cap IJS, 20% Total Stock Market VTI)

Bonds: 40% (20% Long-Term Treasury Bond TLT, 20% Short-Term Treasury Bond SHY)

Commodities: 20% (20% Gold Trust GLD)

Backtest of data:

Using data from lazyportfolioetf.com

Assuming all dividends reinvested, rebalanced at the start of every year

This is a really interesting return, as we can see that in 15 years rolling returns, the average annual return is 9.34%, and the worse possible case is 7.09%. I would say that I would want 20-years rolling returns ... so...

But there is a need for you to understand that it doesn't mean that you will not experience losses, there is still a standard deviation of 8.28%. It just means that over a long period, there is a lowered chance of you ending up losing money.

Thoughts and comments:

I would say that I can understand the appeal of this portfolio, as it has a higher exposure to safer assets and hence, would have a more consistent return. It would be suitable for investors who do not want to see too big a drop in their portfolio and would let their emotions take control of their investment approach.

I would say that if you can stomach the fluctuations of the market, you can consider sticking to a more risky portfolio. But yes, you should always try to understand your risk appetite.

Sources:

https://www.theoptimizingblog.com/golden-butterfly-portfolio/

https://portfoliocharts.com/2016/04/18/the-theory-behind-the-golden-butterfly/

http://www.lazyportfolioetf.com/allocation/golden-butterfly/

https://www.thesimpledollar.com/investing/retirement/why-i-chose-this-controversial-all-weather-portfolio-for-my-life-savings/

https://portfoliocharts.com/portfolio/golden-butterfly/