Remember when I talked about the inventor of the first index fund - John Bogle? He has a fan club, known as the Bogleheads, a group of superfans of him. They have created this portfolio that is in line with John Bogle's approach to investing; Low-cost, tax-efficient, and diversification.

The portfolio only consists of 2 types of assets, made up of 3 funds (which explains the name of the portfolio). The 2 assets are just stocks and bonds - as what John Bogle has outlined in one of his books (The little book of common sense investing).

The funds are as the following:

1. US stock index fund (either the large-cap or the total US market)

2. International stock index fund (excluding the US, so that you do not double invest)

3. US bond index fund

Yes. I was really surprised by the simplicity offered by this portfolio. In his book, John Bogle iterated on his belief in US enterprises (especially about the long-term returns of the US is around 7% after inflation). But he emphasized that there is a need for diversification in other countries' economies and enterprises as a hedge that other countries have a higher growth potential compared to the US (as it is a developed country).

Now that we have a clear idea of the portfolio, let's take a look at the allocation. #Do note that there isn't a one-size-fits-all approach for this portfolio. you are expected to increase or decrease your volatility in accordance with your financial circumstances. John Bogle himself has recommended for bond weightage to increase as you age.

For the example used in my blog, I will be using an example of a 24 years old male (I got the allocation from the Vanguard questionnaire).

3-fund portfolio allocation:

- Total US Stock market index fund/etf - 60% (VOO, VTI. So long as it is low-cost around 0.15% expense ratio)

- International Stock market index fund/etf - 20% (VXUS, ACWS. It must include developed and emerging markets, excluding the US. Remember LOW EXPENSE)

- US Treasury bonds/US Investment-grade corporate bonds - 20% (VGLT, ITE or LQD. You can choose treasury bonds for the safer aspect or high-grade corporate bonds for slightly higher risk. I would choose treasury bonds)

Comments:

For my personal portfolio, I would stick to the asset prescribed here, but I would prefer long-term treasury bonds (VGLT). This is as I would prefer the non-volatile portion of my portfolio to be even more stable when the rest of the portfolio is going everywhere. Also, you can see that by using this portfolio, you can essentially pivot between the US and other parts of the world's companies (so you can decide how you want to focus your portfolio)

So yes, under the adaptation to Singapore section, I will talk about how I plan to incorporate this into my personal portfolio (*hint* CPF *hint*)

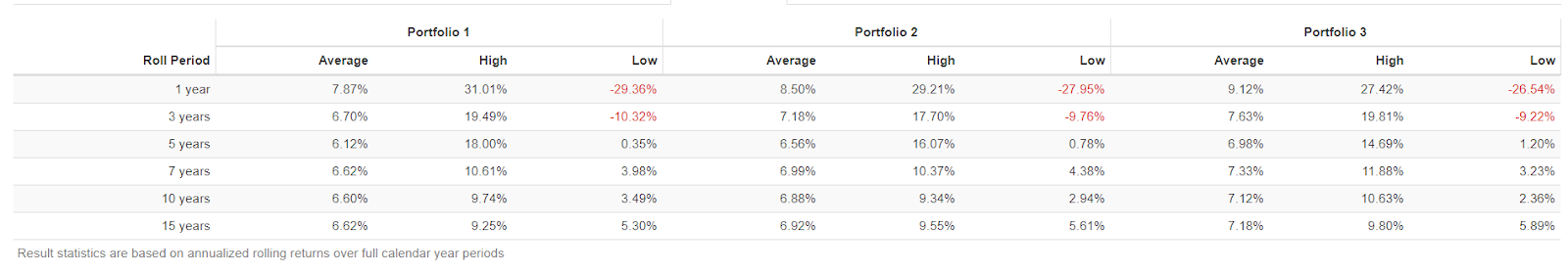

Backtest of 3-fund portfolio (Jan 1997 - May 2020):

Portfolio 1: 20% Bonds + 20% US Stocks + 60% International Stocks

Portfolio 2: 20% Bonds + 40% US Stocks + 40% International Stocks

Portfolio 3: 20% Bonds + 60% US Stocks + 20% International Stocks

So... unsurprisingly, the US-centric portfolio has a higher Sharpe ratio compared to the rest. But it does not mean that it will be the same going forward (that's why there is a need to diversify)

The graph shows the same too (That's why John Bogle has said too: Do not bet against American enterprises. But yes, he also said to allow for other markets with higher growth potential in our portfolio.)

Rolling returns (For a long holding period, what will happen to our money):

As expected, the longer the holding period, the more consistent the returns across different time periods.

As expected, the longer the holding period, the more consistent the returns across different time periods. Do let me know if you are interested in the pdf for the results and I will email it to you, I can't seem to upload it onto this platform.

Adaptation to Singapore:

Alright! This is the important part that you guys are here to see. You love the 3-fund portfolio and you want to apply it. This is how I plan to apply it for the Singapore context and you might want to apply that for your own portfolio.

As you know, we have something known as CPF in Singapore. This is really important as we are required to contribute around 20% of our salary to it in the working portion of our lives. It also gives a 4% interest rate (I'm only calculating SA) annually So my plan is to substitute the bond portion of the portfolio with CPF and use invest the rest of my money to the S&P 500 and the International market.

This will be a rough estimation of my portfolio at age 40:

- Stocks (69.06%)

- Bonds (CPF - 30.94%)

Total = S$1.1 Million.

Conclusion:

As always, this is my plan for my personal portfolio. Hence, you should tailor it to your personal situation. But yes, even though John Bogle has created index funds 50 years ago, they are more relevant than ever today.

With that,

I end today's topic.

Stay vested, Stay frugal my friends,

Dionysius

Source:

https://www.bogleheads.org/wiki/Three-fund_portfolio

https://personal.vanguard.com/us/FundsInvQuestionnaire

0 comments:

Post a Comment