I hope that you have benefitted well in the previous famous portfolio entry. Previously we have talked about the investment approach of Warren Buffett. Today, I am going to talk about the passive investment approach of a Hedge Fund Owner; Ray Dalio.

Of course, let me start off with some interesting facts about him:

1. He found Bridgewater Associates, which became the largest hedge fund in the world, with US$160 Billion AUM

2. He was not a good student until college, before that, he did not perform academically

3. He predicted the 2007 Great Financial Crisis, Bridgewater's flagship fund gained 9.5% during that period.

4. He signed "The Giving Pledge", committing to giving half of his net wealth to charity. This was done with Bill Gates and Warren Buffett.

5. He was born into a working-class family. He started investing at 13 years old.

Now that you know more about this legendary man. Let us take a look at the portfolio composition of his All-Weather portfolio. Oh right, in an interview for Money Master the Game, Ray Dalio has mentioned that this portfolio of him will produce positive returns most of the time, in any economic environment. Hence, we will be putting that to the test along with the leveraged version of the All-Weather portfolio.

All-Weather Portfolio Composition:

US stocks - 30% VTI

Long-Term Treasuries Bonds - 40% TLT

Intermediate-Term Treasuries Bonds - 15% IEI

Commodities - 7.5% GSG

Gold - 7.5% GLD

Leveraged All-Weather Portfolio Composition:

2x Large-Cap US stocks - 30% SSO

2x Long-Term Treasuries Bonds - 40% UBT

2x Intermediate-Term Treasuries Bonds - 15% UST

2x Commodities - 7.5% DIG

2x Gold - 7.5% UGL

Woah. Hold up. What is leverage?? Alright. This is something that I did not explain in my Finance 101 series. Leverage is like an amplifier, it allows for increased returns, just like how it allows for greater losses. Also, there is a higher expense ratio in leveraged ETF as compared to normal ETFs.

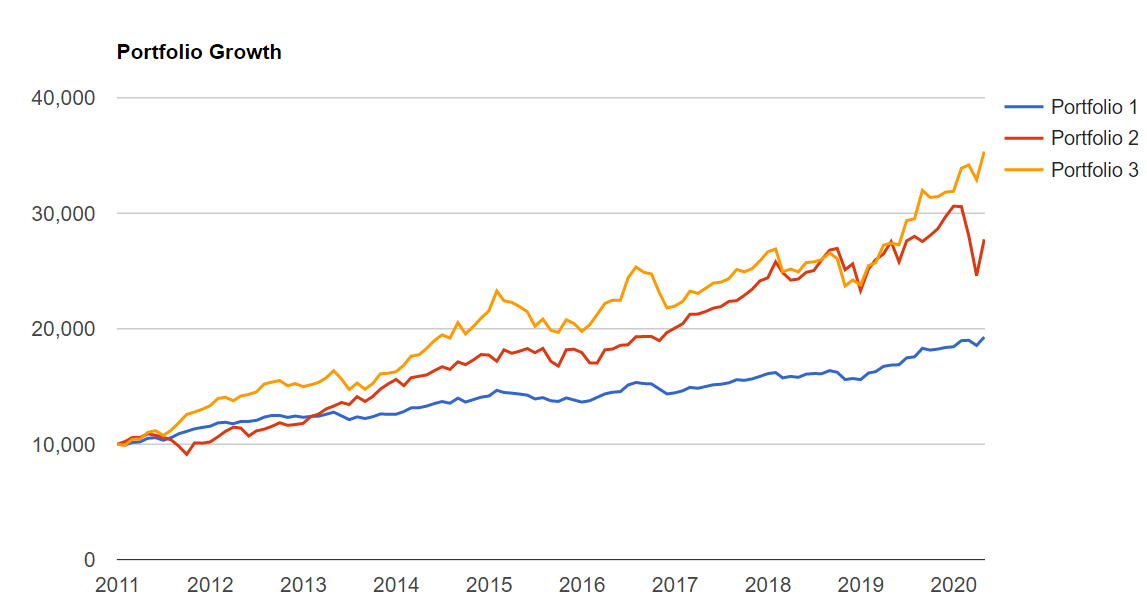

With that, let us take a look at the performance of the All-weather Portfolio (Portfolio 1), the 2x Leveraged All-weather Portfolio (Portfolio 3) and compare it against the S&P 500 (Portfolio 2) (2011-2020) :

As we can see here, the results are kinda surprising. Especially seeing how the portfolio 3 outperformed the S&P 500. This is a higher return, with lower St. Dev and a lower Max. Drawdown. ##Of course, I am not factoring in the cost of investment (Which is higher for a leveraged ETF)## But the normal All-Weather portfolio also has a return 65% of the S&P 500's returns while only 35% of the max drawdown.

If you have remembered, I have taken a look at the distribution of returns of the All-Weather portfolio over the 20 years and 30 years time horizon. Hence, we know that the All-Weather portfolio has this one advantage. It is really really safe. It can protect your assets if you are willing to forsake the potential of a higher return brought by an all-stocks portfolio.

Limitations:

I have only used backward data from 2010 to 2020. Hence, they are not indicative of future performance. I have also not factored in the cost of investments between the different portfolios.

Thoughts and comments:

Imagine, having this portfolio that will make you money no matter what economic situations we may be in. That would be an attractive option, isn't it? Hence, if you wish for your money to have a decent return and not have such a high risk and lose sleep over it, I would highly recommend that you take a look at this portfolio.

With that,

I end today's topic.

Stay vested, Stay frugal my friends,

Dionysius

PS: I cannot find information beyond 2007 for the All-Weather portfolio... This is the earliest I could go.

Sources:

https://betterspider.com/all-weather-portfolio-ray-dalio/

https://www.theoptimizingblog.com/leveraged-all-weather-portfolio/

https://www.portfoliovisualizer.com/backtest-portfolio?s=y&timePeriod=4&startYear=1985&firstMonth=1&endYear=2020&lastMonth=12&calendarAligned=true&includeYTD=false&initialAmount=10000&annualOperation=0&annualAdjustment=0&inflationAdjusted=true&annualPercentage=0.0&frequency=4&rebalanceType=1&absoluteDeviation=5.0&relativeDeviation=25.0&showYield=false&reinvestDividends=true&portfolioNames=false&portfolioName1=Portfolio+1&portfolioName2=Portfolio+2&portfolioName3=Portfolio+3&symbol1=VTI&allocation1_1=30&allocation1_2=0&symbol2=TLT&allocation2_1=40&allocation2_2=0&allocation2_3=0&symbol3=IEI&allocation3_1=15&allocation3_2=0&allocation3_3=0&symbol4=GSG&allocation4_1=7.5&allocation4_2=0&allocation4_3=0&symbol5=GLD&allocation5_1=7.5&allocation5_2=0&symbol6=VFINX&allocation6_1=0&allocation6_2=100&symbol7=SSO&allocation7_3=30&symbol8=UBT&allocation8_3=40&symbol9=UST&allocation9_3=15&symbol10=DIG&allocation10_3=7.5&symbol11=UGL&allocation11_3=7.5

https://www.portfoliovisualizer.com/backtest-portfolio?s=y&timePeriod=4&startYear=1985&firstMonth=1&endYear=2020&lastMonth=12&calendarAligned=true&includeYTD=false&initialAmount=10000&annualOperation=0&annualAdjustment=0&inflationAdjusted=true&annualPercentage=0.0&frequency=4&rebalanceType=1&absoluteDeviation=5.0&relativeDeviation=25.0&showYield=false&reinvestDividends=true&portfolioNames=false&portfolioName1=Portfolio+1&portfolioName2=Portfolio+2&portfolioName3=Portfolio+3&symbol1=VTI&allocation1_1=30&symbol2=TLT&allocation2_1=40&symbol3=VBMFX&allocation3_1=15&symbol4=DBC&allocation4_1=7.5&symbol5=GLD&allocation5_1=7.5

https://www.theoptimizingblog.com/leveraged-all-weather-portfolio/

https://www.portfoliovisualizer.com/backtest-portfolio?s=y&timePeriod=4&startYear=1985&firstMonth=1&endYear=2020&lastMonth=12&calendarAligned=true&includeYTD=false&initialAmount=10000&annualOperation=0&annualAdjustment=0&inflationAdjusted=true&annualPercentage=0.0&frequency=4&rebalanceType=1&absoluteDeviation=5.0&relativeDeviation=25.0&showYield=false&reinvestDividends=true&portfolioNames=false&portfolioName1=Portfolio+1&portfolioName2=Portfolio+2&portfolioName3=Portfolio+3&symbol1=VTI&allocation1_1=30&allocation1_2=0&symbol2=TLT&allocation2_1=40&allocation2_2=0&allocation2_3=0&symbol3=IEI&allocation3_1=15&allocation3_2=0&allocation3_3=0&symbol4=GSG&allocation4_1=7.5&allocation4_2=0&allocation4_3=0&symbol5=GLD&allocation5_1=7.5&allocation5_2=0&symbol6=VFINX&allocation6_1=0&allocation6_2=100&symbol7=SSO&allocation7_3=30&symbol8=UBT&allocation8_3=40&symbol9=UST&allocation9_3=15&symbol10=DIG&allocation10_3=7.5&symbol11=UGL&allocation11_3=7.5

https://www.portfoliovisualizer.com/backtest-portfolio?s=y&timePeriod=4&startYear=1985&firstMonth=1&endYear=2020&lastMonth=12&calendarAligned=true&includeYTD=false&initialAmount=10000&annualOperation=0&annualAdjustment=0&inflationAdjusted=true&annualPercentage=0.0&frequency=4&rebalanceType=1&absoluteDeviation=5.0&relativeDeviation=25.0&showYield=false&reinvestDividends=true&portfolioNames=false&portfolioName1=Portfolio+1&portfolioName2=Portfolio+2&portfolioName3=Portfolio+3&symbol1=VTI&allocation1_1=30&symbol2=TLT&allocation2_1=40&symbol3=VBMFX&allocation3_1=15&symbol4=DBC&allocation4_1=7.5&symbol5=GLD&allocation5_1=7.5

0 comments:

Post a Comment